Tulsa Ok Bankruptcy Specialist Can Be Fun For Everyone

Table of ContentsTulsa Debt Relief Attorney Things To Know Before You Get ThisOur Chapter 13 Bankruptcy Lawyer Tulsa PDFsGetting The Bankruptcy Attorney Tulsa To WorkBest Bankruptcy Attorney Tulsa Things To Know Before You BuyThe 8-Second Trick For Tulsa Bankruptcy Attorney

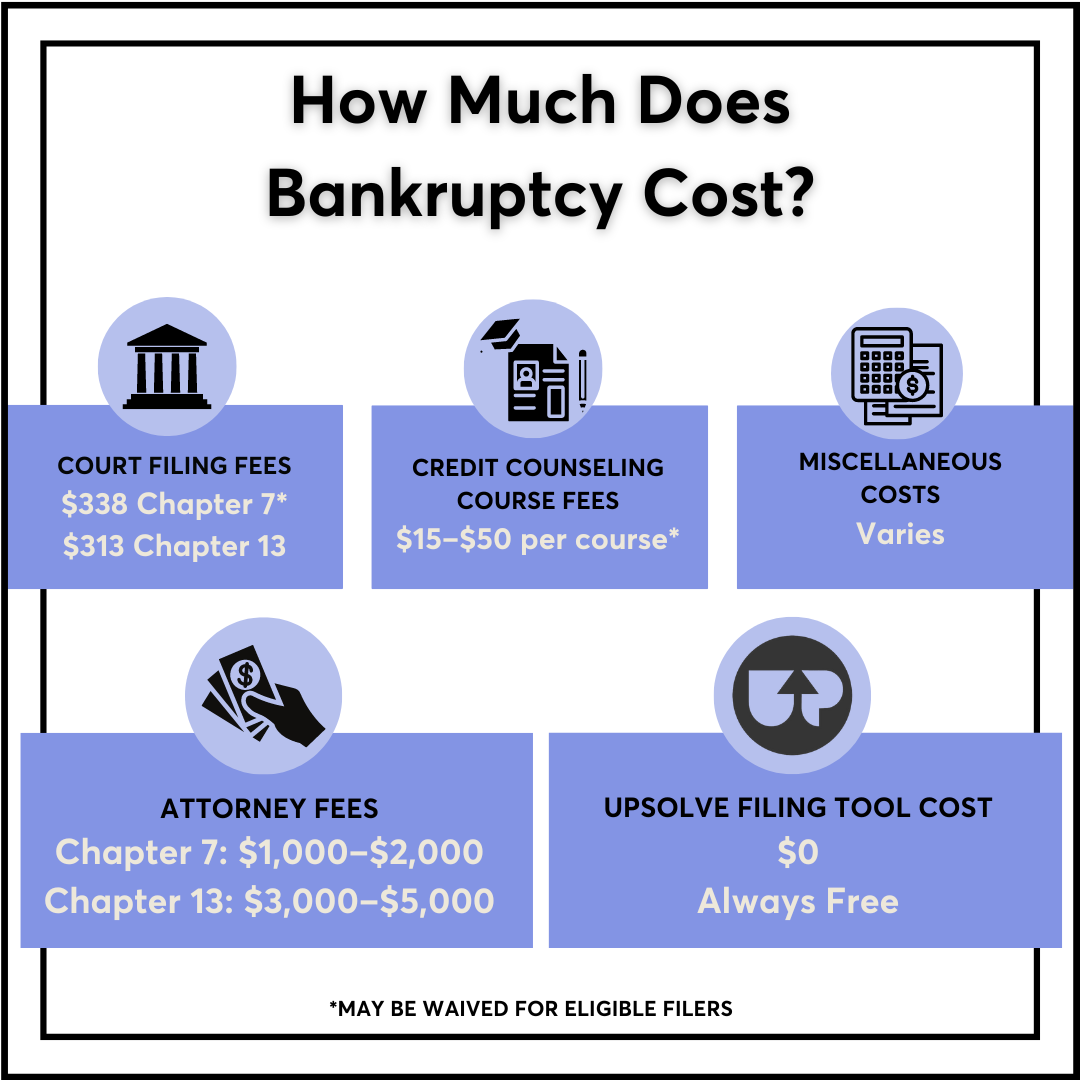

The statistics for the various other primary kind, Phase 13, are even worse for pro se filers. Suffice it to state, talk with a legal representative or two near you who's experienced with personal bankruptcy regulation.Lots of attorneys additionally supply cost-free consultations or email Q&A s. Make the most of that. (The charitable app Upsolve can help you locate complimentary appointments, resources and legal assistance cost free.) Ask if bankruptcy is certainly the right choice for your situation and whether they believe you'll qualify. Prior to you pay to submit personal bankruptcy forms and blemish your credit rating record for up to ten years, check to see if you have any kind of practical alternatives like financial debt negotiation or non-profit credit report counseling.

Ad Currently that you've determined personal bankruptcy is certainly the best course of activity and you hopefully cleared it with a lawyer you'll require to get started on the documents. Prior to you dive right into all the main personal bankruptcy forms, you must obtain your own files in order.

The 30-Second Trick For Chapter 13 Bankruptcy Lawyer Tulsa

Later down the line, you'll actually require to show that by revealing all kinds of details regarding your financial affairs. Below's a basic list of what you'll need when traveling ahead: Recognizing papers like your motorist's license and Social Safety card Tax obligation returns (approximately the past 4 years) Evidence of revenue (pay stubs, W-2s, self-employed revenues, income from properties along with any type of revenue from federal government benefits) Bank declarations and/or pension declarations Proof of value of your properties, such as automobile and real estate evaluation.

You'll want to comprehend what type of financial debt you're attempting to solve.

You'll want to comprehend what type of financial debt you're attempting to solve.If your earnings is also high, you have another choice: Chapter 13. This alternative takes longer to resolve your financial obligations due to the fact that it needs a long-lasting payment plan generally three to 5 years before several of your staying financial debts are cleaned away. The declaring process is also a great deal a lot more complex than Chapter 7.

Little Known Questions About Top-rated Bankruptcy Attorney Tulsa Ok.

A Chapter 7 bankruptcy stays on your credit rating record for 10 years, whereas a Phase 13 bankruptcy drops off after seven. Prior to you send your personal bankruptcy kinds, you must first complete a necessary course from a credit score counseling agency that has been approved by the Division of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The training course can be completed online, in individual or over the phone. You have to finish the course within 180 days of declaring for personal bankruptcy.

The Facts About Which Type Of Bankruptcy Should You File Revealed

An attorney will commonly manage this for you. If you're filing on your very own, recognize that there are concerning 90 various personal bankruptcy districts. Examine that you're filing with the correct one based upon where you live. Tulsa bankruptcy attorney If your long-term house has actually relocated within 180 days of filling, you must file in the district where you lived the better portion of that 180-day period.

Commonly, your personal bankruptcy attorney will certainly work with the trustee, yet you might need to send out the individual files such as pay stubs, tax obligation returns, and financial institution account and credit rating card content declarations directly. An usual mistaken belief with bankruptcy is that once you submit, you can quit paying your debts. While bankruptcy can aid you clean out numerous of your unsecured debts, such as past due clinical expenses or individual car loans, you'll want to maintain paying your month-to-month repayments for secured financial debts if you desire to maintain the home.

Little Known Facts About Chapter 7 - Bankruptcy Basics.

If you're at threat of foreclosure and have actually exhausted all various other financial-relief choices, then declaring Phase 13 might delay the foreclosure and assist in saving your home. Eventually, you will still need the revenue to proceed making future home mortgage repayments, in addition to settling any kind of late repayments throughout your layaway plan.

The audit might postpone any kind of debt relief by numerous weeks. That you made it this far in the process is a decent sign at least some of your financial obligations are qualified for discharge.